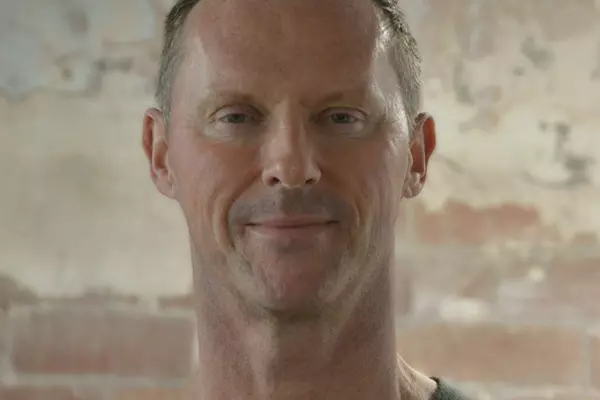

Disgruntled former Syft Technologies chief executive Doug Hastie has sold his 12.8% stake in the company ahead of the online annual meeting in Christchurch tomorrow.

His sale over the past two days of 9,268,581 million shares for $6.95 million follows a scathing attack he made in August about the “sniffer” tech company’s performance and its management and board.

He proposed eight resolutions to be voted on at the AGM in a bid to get the chairman sacked, the board removed and have himself reinstated as a director.

Now that he has quit his shareholding – the second-largest in the company, the resolution calling for his appointment as a director has been withdrawn, leaving seven of his resolutions still on the agenda.

Though Hastie has bowed out after the tit-for-tat round of accusations and counter defences between him and the board he will still attend the online meeting because he has proxies from shareholders in support of his resolutions.

The first four relate to the board. One is about the company’s constitution and the appointment of directors, two about listing on the NZX and one questions a loan made to Syft Technologies under the “business finance guarantee scheme”.

No support

The board said in a statement it did not support any of Hastie’s resolutions.

When he filed the resolutions, Hastie said he had a major investor willing to buy a significant stake in the business, but only if there was a change at board level.

In the end, it was another investor who bought him out. Hastie said he did not know the buyer as the approach had come from investment advisory firm Forsyth Barr on behalf of a client.

Hastie said he had mixed emotions about accepting the bid, but did not want to comment further as the sale was still being settled ahead of the AGM.

He sold at 75c a share. Syft Technologies shares were trading today at 89c.

Hastie, who is also the founder of the Chanui tea company, was chief executive of Syft Technologies from 2012 until he resigned in September last year after he was ousted from the board by a narrow margin of 50.9% against and 48.2% in favour.

Syft was spun out from Canterbury University’s commercial arm in 2003 and makes sophisticated spectrometers for testing air quality, detecting organic compounds in food processing, vehicle testing and health monitoring.